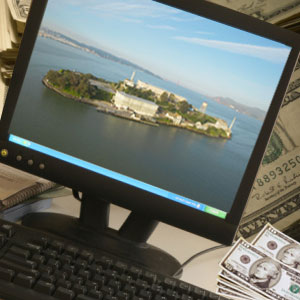

Offshore Banking

Offshore banking is the facility that affords transfer of some or all of the money out of ones’ bank or credit union to anywhere in the world. An offshore bank is located outside the resident country in which the depositor resides. Usually offshore banks flourish in typically low tax jurisdictions which are a tax haven for depositors apart from other financial and legal benefits to the holder of the account.

Offshore banking account

The term offshore originally referred to 'Channel Islands’ namely Jersey, Guernsey and others which are physically located at a distance from mainland Britain and which enjoy a tax haven status. Later the term 'offshore’ came to be used figuratively to all such banks that are tax havens regardless of their location. Interestingly most of the offshore banks are located in island nations except for Switzerland, Luxembourg and Anorra which in particular are landlocked.

An offshore bank account is one held in a bank located outside the country of one’s residence. Some of the offshore financial centers include Bahamas, Barbados, Bermuda, Channel Islands, Hongkong, Labuan Malaysia, Luxembourg, Isle of Man, Cook Islands, Mauritius, Panama, Saint Kitts and Nevis, Seychelles, Singapore and Switzerland.

Opening an account with an offshore bank is very simple. Most offshore banks never have to see the account holder in person. All one has to do is write a formal letter to an institution offering offshore facilities for request of information about its various services and appropriate application forms.

Although offshore banks are regulated in one form or the other, their regulations are usually less restrictive than that one prevailing in US or UK. Lesser restrictive regulation abroad is the important lure for potential investors. Offshore banking provides the customer / depositor with tremendous financial and legal advantages. Offshore banking also offers the customer strong privacy and bank secrecy for privileged customers.

Offshore banking

There are many negative associations and connotations related with offshore banking including that it caters to underground economy and organized crime and helps money laundering. A fact that needs to be understood here is that although offshore banks may not be obligated legally to disclose the transaction details of its customers as it is protected by the 'bank secrecy’, this anyway does not make the non declaration of the income by the tax payer or evasion of the tax on that income legal. Simply put, legally no offshore bank prevents the assets from being subject to personal income tax or interest. Offshore banking if normally preferred by:

- Expatriates

- People who frequently travel

- International business persons

- Incorporations with IBCs offshore

The ability to conduct international transactions is a definite advantage of offshore banking. A facility that provides the ability to receive and move money around the world is what is needed by most global trotters who constantly have homes and financial commitments in many parts of the globe. An offshore bank allows its account holder to transact in multiple currencies. For instance, a flexible offshore account enables the international consultant to charge and receive payments in a currency different from his/her resident country.

Offshore banking services

- Offshore banking helps expats who need to move their lives and finances throughout the world with ease of transition to a new country, culture and financial system.

- Offshore banks operate at a lower cost base due to lower overheads and lack of governmental intervention. Therefore they are in a position to provide higher interest rates to the customer than the legal rate of interest in the home country.

- Offshore banking linked to other structures like offshore companies, trusts and foundations have specific tax advantage for some individuals

- Certain offshore banks offer banking facilities not available with domestic banks such as anonymous bank accounts, higher or lower loans based on risk and investment opportunities not available elsewhere.

- Offshore banks provide political and economic stable jurisdictions for depositors to invest without fear of political turmoil and economic distress.

- Internationally accepted debit cards in various currencies are offered by offshore banks. Global payment and cash withdrawal facilities provide easy access to cash wherever in the world the client might be.

- A wide range of advice on investment, property and retirement planning solutions through a specialist team of financial advisers is provided by offshore banking services. Independent and impartial financial guidance is made possible for the depositor.

- A range of mortgage facility schemes are available in offshore banks for those seeking to purchase property in prime countries. Foreign mortgage pitons are also available making repayments in a range of currencies possible for the customer.

Top of the Page: Offshore Banking

Tags:#offshore banking #offshore banking account

Managing Money

Managing Money Money Saving Tips

Budgeting

Loan

Offshore Banking

Prepaid credit card

Secured Credit Card

Bad Debt Credit Card

Automated Teller Machine ATM

Investing

Grants for Women Starting a Business

Credit Card Reward Program

Prepaid Travel Money Card

Travel Reward Credit Card

Credit Card Debt Elimination

Consumer Debt Counseling

Repair Credit Score

Voluntary Repossession

Retirement Planning Calculator

Personal Debt Consolidation Loan

Identity Theft Prevention

Money Transfer Overseas

Online Insurance Quote Guide

Self Employed Health Plans

Top of the Page: Offshore Banking

Popularity Index: 100,901